Recession Stock market Investing | Secrets Top 1% Know to make profits in Recession Market Exposed | How to make money in Recession

Secrets Top 1% Know to make profits in Recession Market, how to make money in Recession, Recession Stock market Charts and Recession Investing are topics we will cover today in this article.

Summary

What if we told you that upcoming recession can make you Rick ? Secret Top 1% use to make money in Recession that helps rich get richer and poor are unaware about. Today in this article we are exposing rich mentality and help our readers to be ready for potential recession market and earn the best profits in the market even when markets are falling.

Get ready for Financial revolution that can change your vision to look at the world of Finance !

Table of Contents

Understanding, What is Recession?

Recession is Latin word, which means ‘Retreat’ or ‘To go back’.

Recession in today’s context is said when a country experiences turmoil in the economy , experiences a considerable fall in Stock market and mass fear can be seen in the economy. One can even notice financial downfall of the major organization, job losses and layoffs all over the job market and unemployment on a large scale.

Top 1% Investors who make huge money and profits in such markets do know variety of Tricks and tips which we are going to discuss in this article. If you have any queries, feel free to comment down below and we will come back to you.

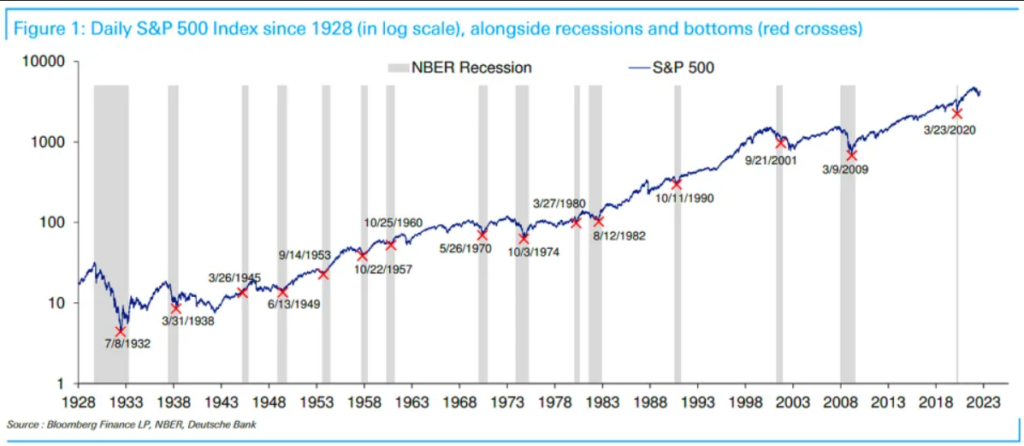

Recession Stock market Chart

How to invest during Recession

Investing in recession do require a lot of planning which one needs to do when nation is not in Recession. Currently we are not officially in recession, so it is the perfect time to plan ahead for Recession investment planning.

We need to plan ahead our position and investment strategies during current phase of market cycle, below are the points one need to keep in mind –

Preparation Phase, Before Recession.

Cash is King

When economy is tumbling downstairs or gives a sign that economy is halo, then one need to increase his cash position, which means one should hold good amount of cash at disposal to be invested in market.

One should have enough cash in hand which he can survive without income for next 8 months and can invest in 5-7 tranches to average downward and buy at low valuations. Ideally as per thumbs rule, one should hold around 20% of position in cash.

Boom Phase spending and Emergency fund.

In a Boom market, when economy is in constant growth phase it is noticed that individuals do enjoy the lavish lifestyle and heavy expenditure is done on material and luxurious items.

You should know that such growth phase are temporary and always build your emergency fund which can be parked in Debt market instruments and Fixed income assets which are liquid in nature.

Portfolio Asset Allocation

One should plan his asset allocation wisely, so as to have a good defensive portfolio which can handle any volatility in market. This can be achieved with investment in safer assets and instruments such as Government Bonds or Corporate bonds, which has lower volatile as compared to stock market and also give decent returns.

Ideally one should have around 40% of his portfolio in Debt Instruments, Dept instruments consists of bonds, debentures and Fixed income instruments.

Do Not PANIC

You should not panic when you see your investments bleeding and going down in value drastically. You should avoid being emotionally connected to your portfolio and sell any of you investment in panic or fearful market conditions.

Remember, investment is a long-term game and markets may go up and down drastically, however in a long run stock market and other asset classes give a positive returns. The losses which you might see are just paper losses and are not real until you sell your investments at a loss.

As per Warren Buffett, the most successful investor says ” Market crashes are inevitable, and no matter how low market touches, markets will eventually bounce back and reach new heights.”

Investment Phase, Recession Phase.

Real Estate Investing

Real estate is a prime example of an investment opportunity which becomes more lucrative and affordable during recession phase.

Due to negative growth and unemployment in the economy many people do loose their jobs and life savings, in this case they tun to their house to liquidate and sell their real estate.

They might be in an urgent need of cash and sell their real-estate investment at a much lowered value then market rates. This will create huge number of real estate property to be in the market for quick sell which will drastically reduce prices of such property even further.

You should hunt for such properties which are very undervalued then market and invest in these real estate. Once the market recovers and economy stabilizes, you will make huge returns on this investments

Stock Market Investment

As Economy is in Fear state and individuals lost their confidence in stock market, we can witness mass Selling in stock market. People will be in need of cash due to no savings, this will insert additional pressure on stock market as more and more people will be selling their stock investment irrespective of the current price of the shares.

This is the perfect time to invest in undervalued stocks. You should pick fundamentally good stock with good cashflows and the company which you think will survive the stock maket crash and economical distress.

As you know the market cycle and have confidence in economy that it will bounce back, you should not panic sell but take advantage of other’s fear and accumulate heavy amount of stock investments. Once the economy will bounce back, your stocks will reach rational valuations and you will enjoy great reruns in the future.

A classic example will be latest 2020, Covid Stock market crash. We witnessed a crash of around 35% in overall Market, which was later recovered in just 4 months. Markets have given more then 100% return till December 2021.

Stock selection

One should select Fundamentally good stocks which solves mass problems efficiently.

As one can consider investing in Consumer segment, online entertainment, affordable glossaries etc which will solve basic needs of the consumers and whose demand will never fall.

Avoid leveraged Companies

You should not invest your money in companies that are highly leveraged. This means you should not invest in companies with high Debt and loans in its books as due to cashflow constrains, these companies may not be able to fulfil its obligations and may default. This will heavily impact your wealth building journey in a long run.

Stable Companies

You should invest your money in stable companies, which has proven historical records and have shown consistently high growth. A company with good cashflow management, high standards of corporate governance, Low loans and debts positions are companies you should target to invest.

Please remember, in recession conditions even theses companies will lose a lot of their valuations. So you have to invest in various tranches, which means you should decide levels at which you will invest your money and not invest all of your money at 1 level.

Conclusion

You should remember the most important thing, that the Market recession is temporary in nature and market dips are not here to stay for a long time. You should invest as much as you can in this market crashes to enjoy lower valuations which will help you in wealth creation.

The biggest investors are always created in stock market crash, so do not panic but plan well in advance and execute the plan in market dips

Market recessions are like Discounts in supermarkets, where you can buy same stocks and securities at much lower valuations and enjoy Wealth creations.