8 Best Vanguard Funds | Best Vanguard Mutual Funds and ETF | Vanguard Fund returns

In today’s world, we do have lot of options to invest our money however due to many options investing can become tough and confusing at times. Investing process should ideally be simple, hassle-free and easy to understand. Investing in Mutual funds or Index funds do tick all the boxes and, in this article we have collected the Best Vanguard Funds for Wealth Building

Table of Contents

Overview

Vanguard Asset Management does provide its investors with 419 funds, we have shortlisted 8 Funds which covers various segments to acieve your financial goal. We have coverd funds from Equity, Debt, International Equity, Real estate sectors and also included Mid cap and Small cap oriented funds for risk oriented investors.

Equity Fund, Vanguard Total Stock Market Index Fund

Vanguard Total Stock Market Index Fund (VTSAX) is considered as the all-time favourite index fund by many investors and have given its investors with great returns. This fund has given an impressive 10.50 % Annual returns over a period of 10 years. This was done with an expense ratio as low as 0.04%. Vanguard Total Stock Market ETF (VTI) manages a total of $ 1.4 Trillion in its Asset Under Management making it the most popular and significant index fund in the market. The primary objective of this fund to track CRSP US Total Market Index, an index which includes an approximately of 4000 publicly traded U.S. companies. VTSAX is designed to be self-cleansing, automatically replacing underperforming companies with new and promising ones.

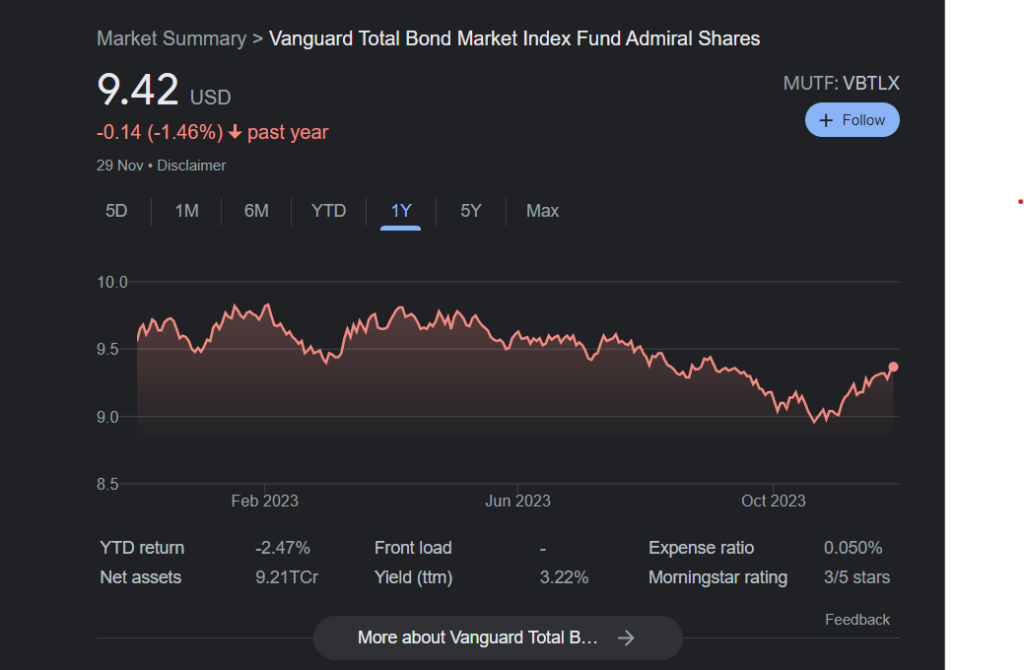

Bond Fund, Vanguard Total Bond Market Index Fund

You should have stability in your investment portfolio, and investing in bond funds do reduce your portfolio’s risk and provide stability. Vanguard Total Bond Market Index Fund (VBTLX) is one of the best bond funds offered by Vanguard. With expense ratio of 0.05% and minimum investment of just $ 3,000, this fund provides its investor a very low cost and low-ticket investment option. VBTLX provide its investor with exposure to U.S. investment-grade bonds.

International Equity, Vanguard Total International Stock Index Fund

For investors looking to invest their funds in international market, Vanguard Total International Stock Index Fund provides a great option. With an expense ratio of just 0.11% and a minimum investment requirement of $3,000, VTIAX aims to make international investing cheaper, more affordable and low-ticket investment option. VTIAX aims to track the FTSE Global All Cap Excluding the United States Index which tracks international equity market. Despite its 10-year average annual return of 4.7%, VTIAX, equivalent to the Vanguard Total International Stock ETF (VXUS), holds assets close to $400 billion and represents around 8,000 international companies.

S&P 500 Fund - Vanguard 500 Index Fund

Vanguard 500 Index Fund (VFIAX/VOO) provides its investors with exposure to 500 largest companies in the U.S. stock market. This fund tracks S&P 500 index which representing the 500 giants of the U.S. market. VFIAX provide its investment service at an expense ratio of 0.04% with minimum investment requirement of $3,000 making it a very affordable and cheap alternative to its investors. This fund, equivalent to the Vanguard S&P 500 ETF (VOO), mirrors the S&P 500

Global Equity, Vanguard Total World Stock Index Fund

Vanguard Total World Stock Index Fund (VTWAX)** stands out to provide its investor with global market exposure with a majority stakes in US Equity market . With an expense ratio of just 0.1% and a minimum investment requirement of $3,000, VTWAX invests their funds of approximately 60% in U.S. stocks markets and rest 40% international stocks representing approximately 10,000 stocks worldwide. This fund is equivalent to the Vanguard Total World Stock ETF (VT) which provides a one-stop solution for those seeking exposure to both U.S. and international equity

Real Estate, Vanguard Real Estate Index Fund

Vanguard Real Estate Index Fund (VGSLX) offers its investors looking to invest their funds in real estate sector to diversify their investment. Investing in real estate is expensive, however if you invest your funds via this fund, you can invest with expense ratio of just 0.12% and a minimum investment requirement of $3,000. VGSLX fund invests their funds in companies present in Real Estate Investment Trust (REIT) which comprises approximately 160 real estate companies, covering various property types. One should invest a proportion of their fund in real estate sector which helps in diversification benefits during times when real estate outperforms stocks.

Small Cap fund, Vanguard Small Cap Index Fund

Vanguard Small Cap Index Fund (VSMAX) offer its investors who are looking to invest their funds in smaller companies and betting on future trends. With an expense ratio of 0.05% and a minimum investment requirement of $3,000, VSMAX represents approximately 1,400 small-cap companies. This fund is specially for investors looking to take risk with their investments for better upside opportunity. One should have a small proportion of funds in small cap as they are very volitive in nature and investors can potentially benefit from much higher rates of growth.

Midcap Fund, Vanguard Midcap Index Fund

Vanguard Midcap Index Fund (VIMAX) provide its investors who are looking to invest their funds in Mid cap companies. Mid cap companies are those companies which are smaller as compared to large cap, but higher as compared to small cap companies. Mid cap provides better opportunity to grow as compared to large cap with better stability as compared to small cap companies. Vanguard offers VIMAX fund with an expense ratio of just 0.05% and a minimum investment requirement of $3,000 and this fund comprises around 340 midcap companies.

Conclusion

With approximately more than 8,000 funds available to investors, Vanguard asset management do provide simple, low-cost, and effective investment options to their investors. Vanguard does have one of the lowest expense ratios which benefit its investors with comparatively better returns as compared to other competitive funds.

Vanguard official website – Vanguard