Credit Card Losses | Understanding the Credit Card Crisis | Credit Card Crisis Impact on You

Credit Card Crisis | Understanding the Credit Card Crisis | Credit Card losses

Credit Card Losses or Credit Card default is a situation when an individual is not able to pay his Credit Card bill due in timely manner.

In the world of economic uncertainty, we have one more storm to face and that is Credit Card crisis. As you see yourself standing in middle of High inflationary environment, Job cuts and unemployment, you will see a surge in credit card defaults and the same will have catastrophic effects on the US Economy.

The burning question is, how will Credit Card crises affect You and US Economy ? And its effect on US Financial markets, our Banks and Stock market will be discussed in today’s article, so stay tuned to be 1% more smarter in 8 minutes of read

Table of Contents

Historical Rise in Credit Card Losses

For you to truly understand the magnitude of Credit Card crisis, it’s important for us to crack some numbers to get into it.

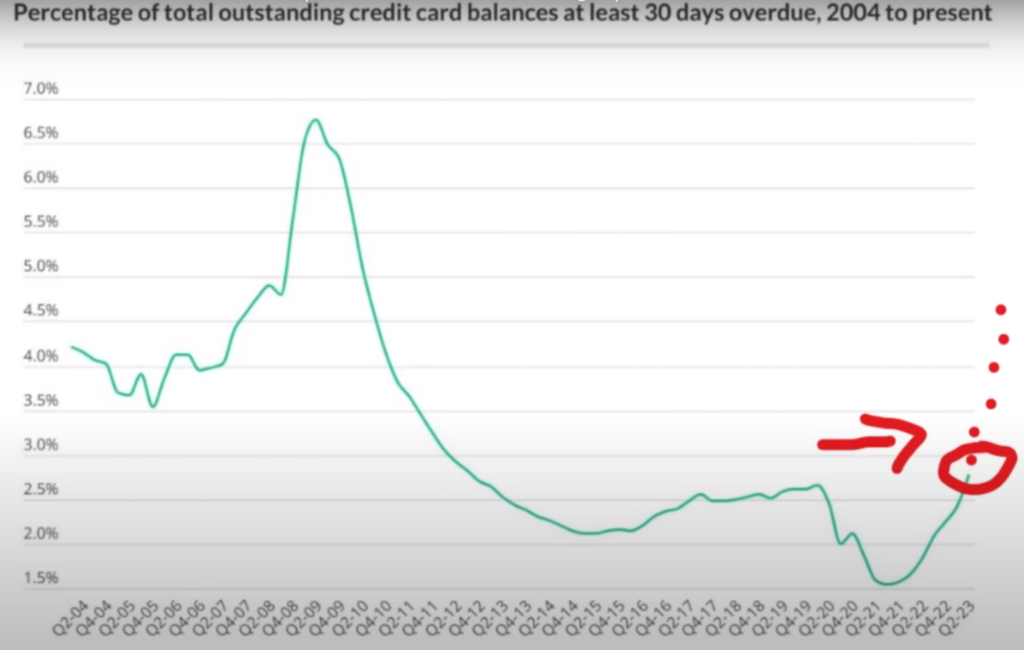

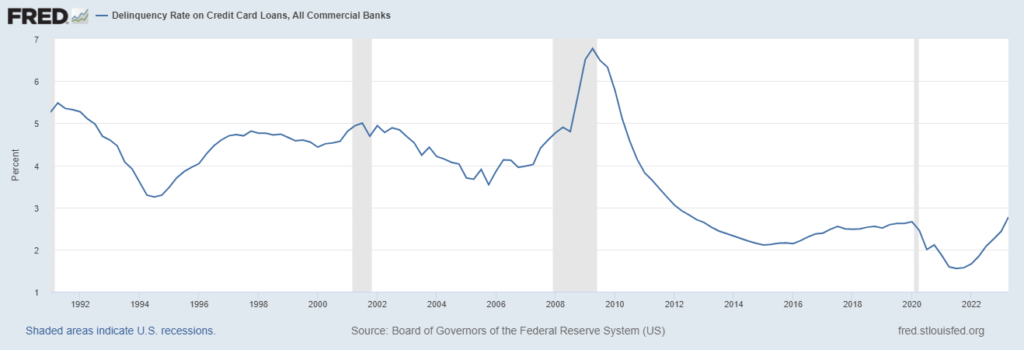

Credit card losses hit the lowest in September, 2021 which was due to stimulus money distributed by the Government and acted as a trend reversal for credit card losses. However, the trend since first quarter of 2022 is nothing short of alarming to the economists. Below chart shows that the credit card losses have increased drastically and the tend will continue in the future.

As we can see from the table, Credit card losses has spiked by 1.5% from the lowest period and big Investment bank Goldman Sachs made a prediction that this trend will continue and credit card loss will rise more aggressively and touch 4.93 % in the near future

To put into context, this credit card default rise was also experienced during the 2008 financial crisis, Graph Source – Federal Reserve System (US)

Many US economists and Global thinktanks believe that this credit card default is just the tip of the iceberg and more pain is yet to be experienced by US citizens. It is estimated that, this trend will continue till late 2024 and can also extend till early 2025.

Credit Card default effect on Economy.

Credit card defaults or credit card losses are not isolated events, however, they have a ripple effect and devastating consequences on the economy. When more and more individuals default on their credit card payments, consumer spending is affected and reduced drastically. This reduced spendings will lead to lower revenue to the companies and lower profits, this in turn will translate in companies moving to cost cutting approach which will cause layoffs and unemployment rises. This vicious cycle will continue and will quickly be out of control of the policy makers.

Currently, Credit card default rate is at 3.63%, which is higher than previous point. If economist’s predictions are considered, we may see default rates crossing a mark of 4.93%. Such a scenario will potentially trigger a recessionary environment. High interest rates and inflation experienced also high credit card defaults means the worse is yet to come and situation can be worse sooner than expected.

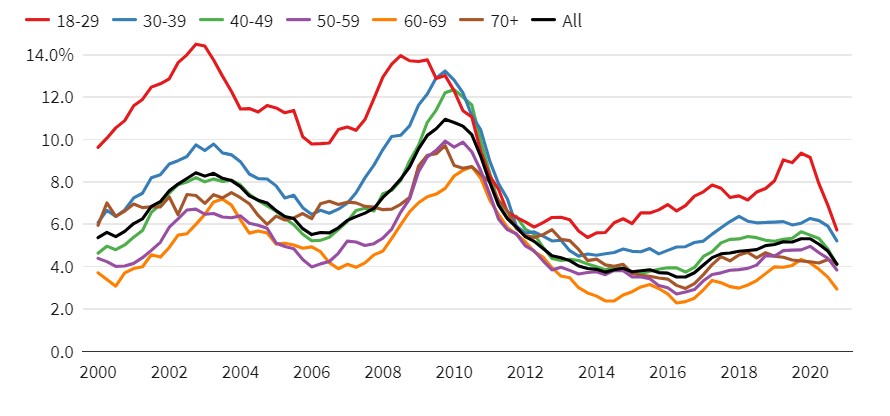

Historical data for Credit card defaults

Historical data often acts as a guide, when we examine previous credit card defaults and loss cycle, a certain trend can be seen. The current scenario Is similar to the situation we experienced in late 1990x and also in 2015-2019 period. Most important factor to note is that, both of these period was followed by robust loan growth in the economy.

As per what we noticed in historical trends, losses are tend to peak at around 6-8 Quartes after loan growth reached its peak. In simple words, we are the the beginning of the journey for a potential economic downturn. Economists suggest that we might not witness the peak of the crisis until late 2024 or early 2025.

Image Source – NewYork Fed.

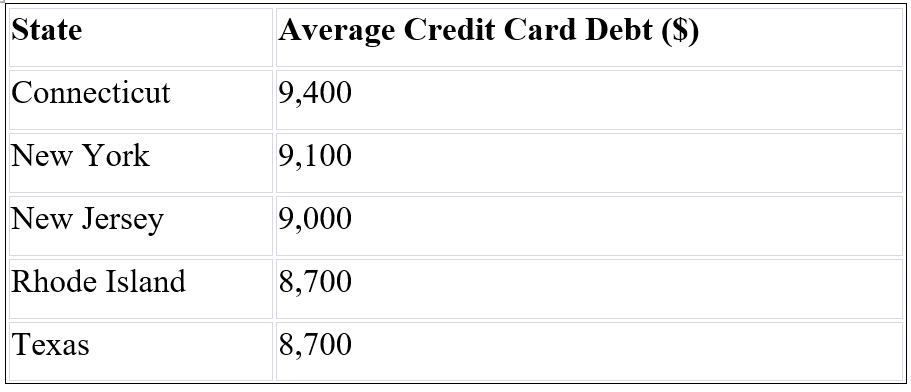

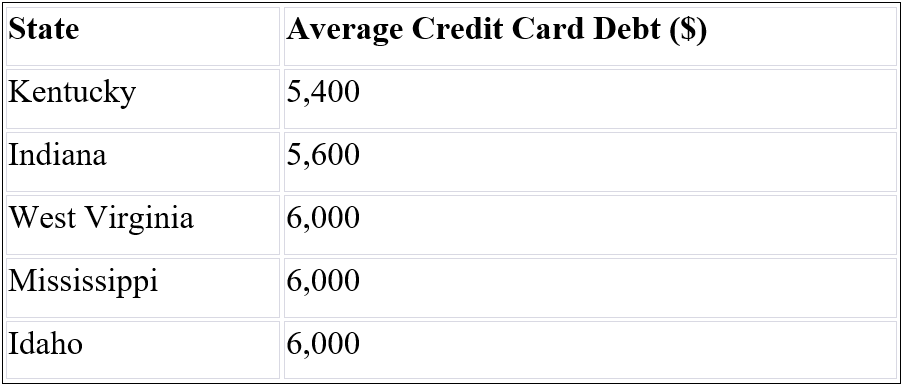

State-By-State Credit card debt analysis.

Understanding Credit card debt in United States as per its geographical distribution is a crucial factor to understand the broader picture. Different states have varying levels of credit card debts, which can serve as an early indicator of economic vulnerability to credit card crises and economic downturn.

Here is a list of the states with the highest average credit card debt:

On the other end of the rope, below states have the lowest average credit card debt:

As per official records, the average Credit card debt of US is at $7,279. You can compare your credit card debt to national average to get better view about your current financial situation.

Hight interest rate impact on Credit Card Defaults

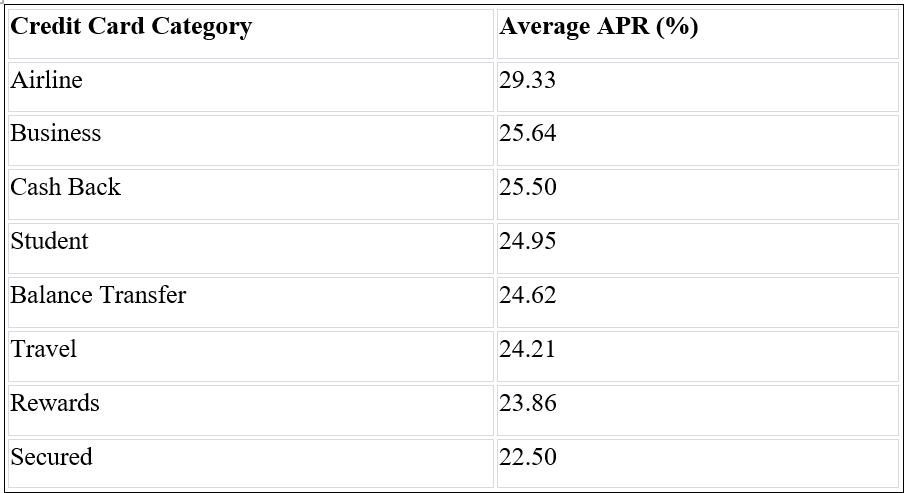

Rapid rise in interest rate is the key driver to escalate credit card default leading to credit card crises. The Average Annual Percentage rate ( APR Rates) for a new credit card is currently at 24.45%, this rate is considerably very high when we factor in employment crisis and uncertain future. This means, many Americans are paying an exorbitant interest rate on their credit card balance.

For contexts, below is the breakdown of interest rates by Credit card category

These high interest rates urge to pay high-interest debt as quickly as possible, if one fails to do so he will be trapped in paying extraordinary default charges which is 1/3 of his credit card bill.

Strategies to Tackle Credit Card Debt

As we have seen the seriousness of the situation, it is crucial to adopt effective strategies to address credit card debt with a planned approach. Below are 3 approaches to consider for managing your Credit card debt:

Prioritize High-Interest Debt

You should identify which of your credit card has the highest interest rate. Once identified, you should target that credit card debt first. Always try to pay full bill amount on such credit cards and paying full is not possible always try to pay the maximum amount you can toward such credit cards to accelerate the repayment process.

Debt Consolidation

Debt Consolidation means taking new loan at lowered interest to pay the loan with high interest rates. By opting for Debt Consolidation option, you will potentially save thousands of dollars in interest payments by paying low interest on new loan and closing high interest debt. You should always consider the cost attached to opting for new loan such as processing fees and other charges. If such charges are much higher, then you should avoid such debt restructure.

The Snowball Effect

You can start paying off credit card debt with lowest balance. Once the lowest debt is paid off, you can use the money to payoff the next lowest balance debt. This snowball effect will help you to build the momentum in your debt repayment journey and you will notice that all of your debts are cleared as time pass by.

Conclusion

In conclusion, the current rise in Credit card Default is a red-flag that should not be ignored by you. Credit card Defaults will have far reaching effects on the US economy and ripple effects can be experienced in the Global economy as well.

If not handled correctly by you as individual and policy makers, it will affect US Economy, US Stock markets, Bond markets, and Employment as individuals will withdraw their saving from all the available resources in order to payoff their high interest rates on credit card bills.

The key takeaway is to plan your credit card debt and never let your debts cross a predetermined limit. You should also have necessary emergency funds and savings to deal with deteriorating economic conditions and potential prolonged economic downturn.