US Bond Market Crash : Worst in US History | US treasury returns falls 3 years in a row

Understanding the Unprecedented Bond Market Crash: What Lies Ahead?

The financial world is currently witnessing an event of unprecedented proportions: a bond market crash that hasn’t been seen in over two centuries. The magnitude of this crisis is staggering, and it’s crucial that we dive deep into the facts and data to understand just how dire the situation is.

In this article, we will explore the historical context, the repercussions of the banking crisis, the current bond market conditions, the role of interest rates and inflation, the resurgence of oil prices, the surge in gasoline prices, the impact on commodities, and the investment opportunities presented by the lithium market, with a spotlight on Fe Battery Metals Corp.

Table of Contents

Historical Context

The Banking Crisis Reminder

The 2008 banking crisis serves as a stark reminder of the interdependence of the bond market and the financial sector. During that crisis, banks faced massive losses as bond and mortgage-backed securities prices plummeted. When everyone rushed to withdraw their money, the banks couldn’t sell their bonds and securities for the prices they paid, leading to further losses. If bonds continue to crash as they are now, we could see more banks facing a similar fate, potentially triggering another financial crisis.

Current Bond Market Conditions

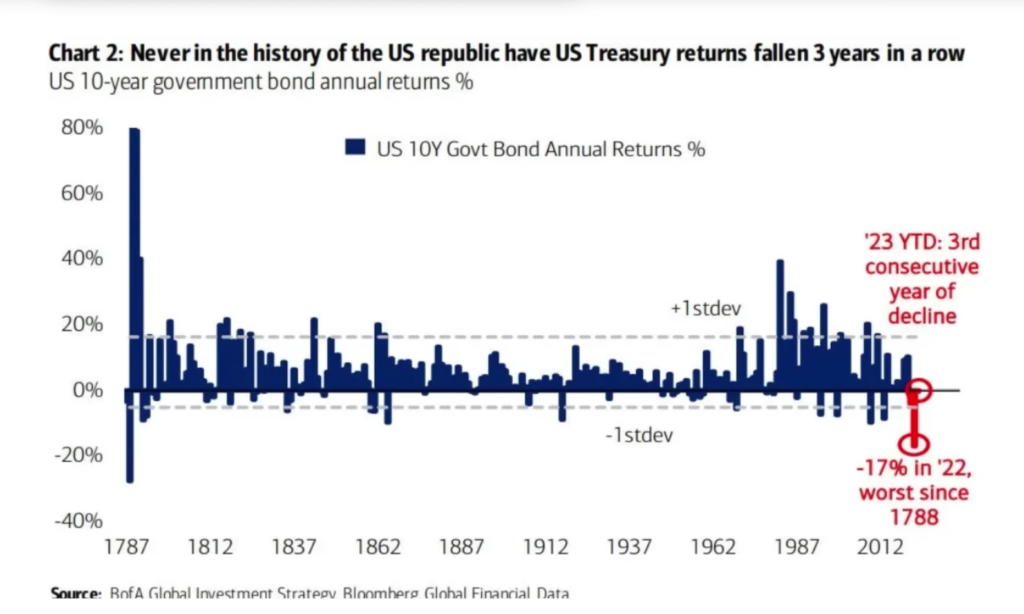

As of 2023, we are witnessing the third consecutive year of declining US Treasury returns. The decline in 2022 was the worst since 1788. Bank of America has issued warnings about the pain felt in the bond market, attributing it to the Federal Reserve’s aggressive interest rate hikes since March 2022. The Fed has hiked interest rates 11 times, bringing the effective funds rate from zero to over five percent. Rising interest rates cause bond prices to fall, which explains the poor performance of bonds.

This decline is alarming, and it prompts us to question whether the assurances from officials that the economy is fine and there’s no need to panic about the banks are warranted. If the bond market continues to deteriorate, it could spell trouble for banks and potentially lead to more financial institutions going under.

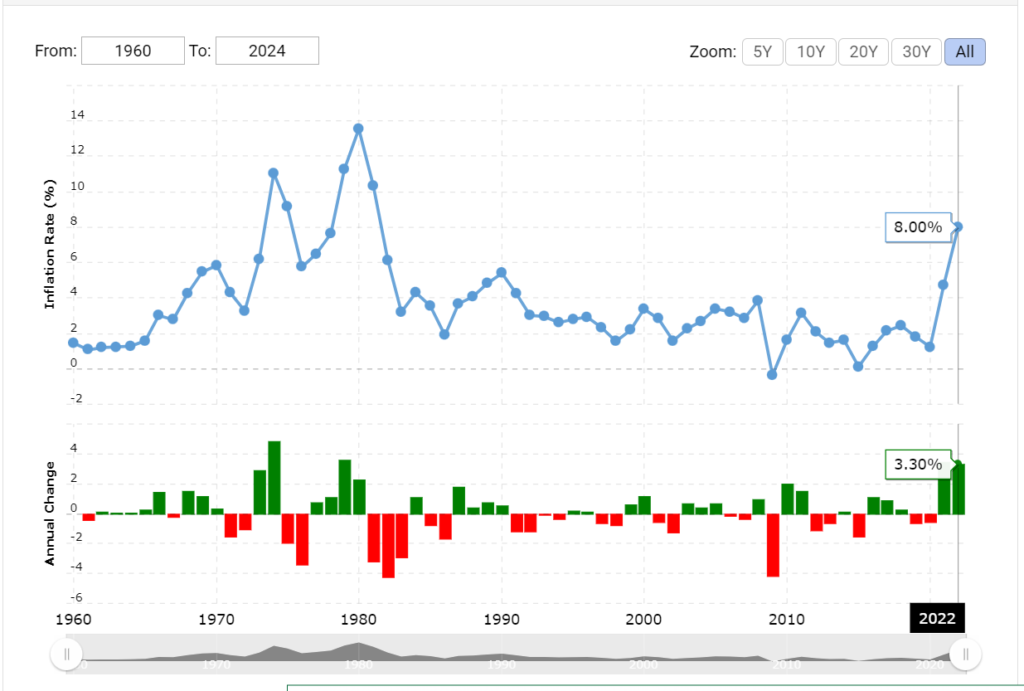

Interest Rates and Inflation

The driving force behind rising interest rates, and consequently the bond market crash, is inflation. Inflation erodes the purchasing power of money, making future cash flows from bonds less attractive. As a result, bond prices fall to compensate for this reduced attractiveness. It’s a vicious cycle, and the current bond market crisis is intimately tied to the Federal Reserve’s interest rate hikes and the inflationary pressures in the economy

Oil Prices and Economic Reopening

Another significant factor impacting the economy is the resurgence of oil prices. In 2022 and the first half of 2023, China’s economy was in a state of turmoil due to lockdowns. However, with China reopening its domestic and international travel, the demand for oil is poised to surge. Oil prices could potentially reach $100 per barrel, which has far-reaching consequences for the global economy.

Oil is the lifeblood of the modern economy, and any substantial increase in oil prices will lead to higher costs for virtually everything, from transportation to manufacturing. This, in turn, can exacerbate inflationary pressures.

Gasoline Price Surge

Gasoline prices have already started to surge, with Labor Day weekend seeing prices near all-time highs. Higher gasoline prices have a direct impact on consumer sentiment and can lead to reduced consumer spending. When consumers see gas prices rising daily, it lowers their confidence in the economy, which can have broader implications.

Consumer goods prices, food prices, and utility bills are all influenced by the cost of gasoline, and a sustained surge in prices could weigh heavily on household budgets.

Commodities and Inflation

The bond market and oil prices are not the only factors contributing to inflation. A closer look at various commodities reveals a worrying trend. Natural gas prices have been volatile, and workers at Chevron’s liquefied natural gas export plants in Australia are planning strikes, which could disrupt production.

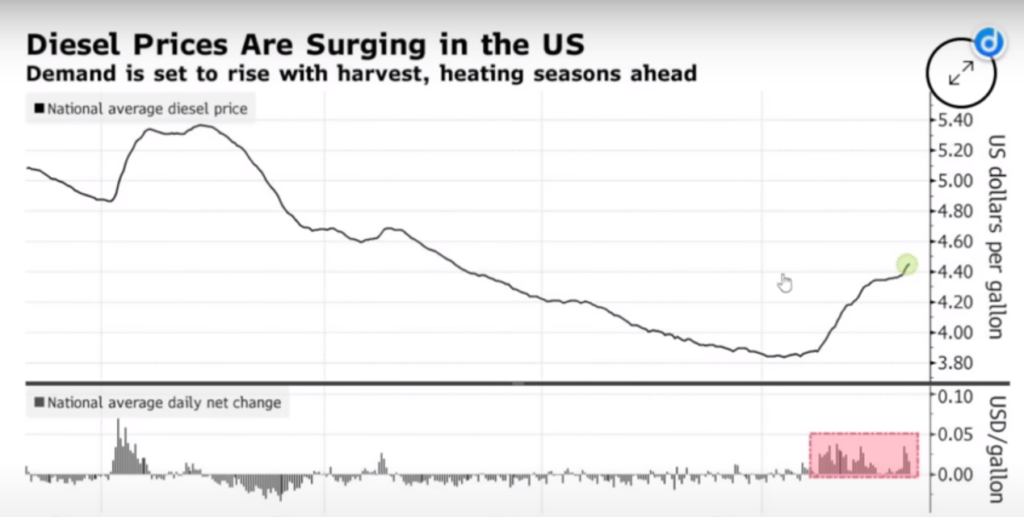

This, coupled with a rapid increase in retail diesel costs in the US, threatens to inflate the costs of farming, heating, trucking, and construction

Opportunity in Lithium

While these economic challenges are daunting, they also present opportunities. One such opportunity lies in the lithium market. Lithium is a critical component of electric vehicle batteries, making it an essential resource in the global shift toward renewable energy and electric mobility

The demand for lithium is expected to grow exponentially, potentially outstripping supply by more than 40 percent by 2040. This surge in demand is driven by the rapid growth of electric vehicles and the renewable energy sector.

Conclusion

The bond market crash, rising interest rates, inflation, surging oil prices, and escalating gasoline and commodity costs are undeniably concerning. However, within every crisis lies an opportunity. The lithium market, with Fe Battery Metals Corp at its forefront, offers potential for substantial growth as the world races to embrace electric mobility and renewable energy sources. As an investor, it’s essential to conduct your own due diligence and consider the opportunities presented by these evolving market conditions. In the face of adversity, there are always opportunities for those who are prepared and informed.

Disclaimer: All investments involve risk, and past performance is not indicative of future results. This article is for informational purposes only and should not be considered investment advice. Make informed decisions and consult with a financial advisor before making any investment.

Publishing Date – 6th September, 2023.

Author – News and Wealth Team