Why do I need Credit Card ? | Why You Should Buy Everything With Credit Cards

Credit cards has become one of the life essential for many individuals due to the flexibility and benefits it offers to its user. Straight from unlimited rewards to Interest free credit there are many benefits of owning a credit card, in this article we will discuss who do you need a Credit card and Why You Should Buy Everything With Credit Cards.

Table of Contents

Understanding Credit Cards

Credit Cards is a financial instrument which provide its holder with a credit line to its holder.

User can utilize this credit line to make the purchase in daily life and pay the amount after set period, it can be from 15 days to 45 days as arranged by their credit card provider.

Holder of the credit card gets rewards in terms of cashbacks or reward points which he can use to avail free services like premium lounge access, free Gas, vacation etc. The holder of the card do not need to pay any interest on the amount utilised. The holder of the Credit card must make sure that he pays all his dues on time without missing any dues, if he misses the payment because of any reason then he will have to pay a considerably large amount as penalty and heavy interest.

As per records, Late payment fees usually cost $15 to $35 and additional of interest which is on average between 27 – 30% for major banks. Therefore, it is very important to use credit card with caution and over spend the credit line available.

Credit Card Rewards

Credit Card Rewards do offer substantial benefit to its holder as they use their card for payments.

Credit Card Rewards can be a in-terms of cashback credited when credit card is used, Free Movie tickets, vacations, or trips when pre-determined amount is used in a year, free lounge access in airports etc.

Most people have the potential to save hundreds of dollars each year by choosing right credit card and using it wisely. Whether you are a frequent traveller or a diehard music lover looking to save on those expensive concert tickets, there is a card tailored for you.

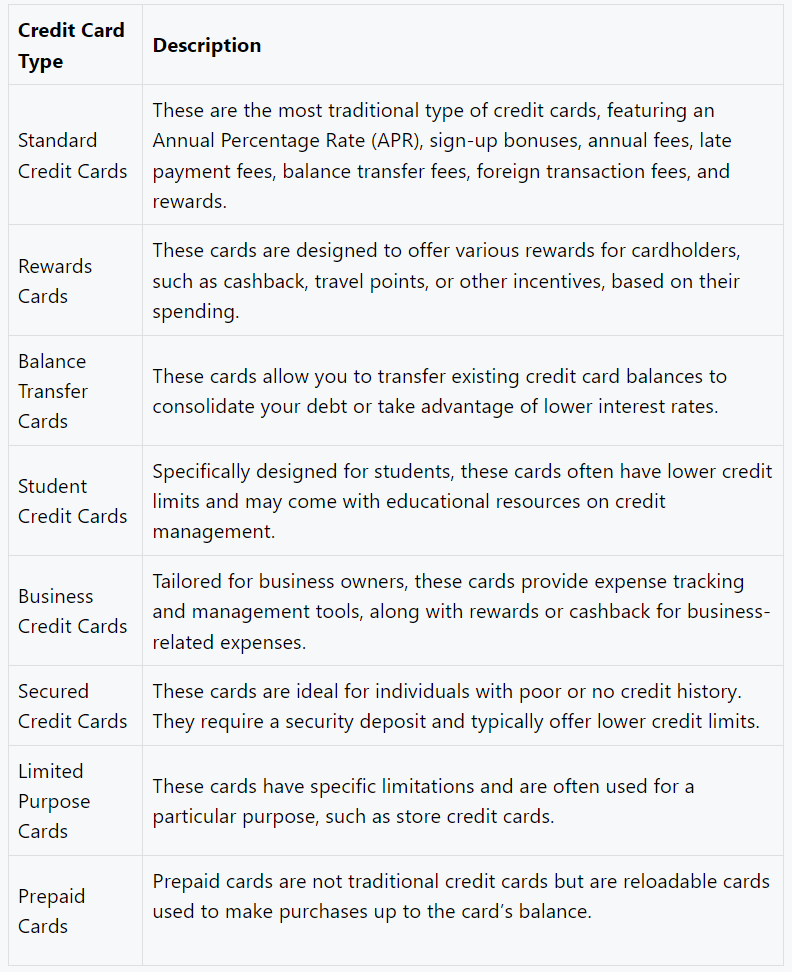

Types of Credit Cards

In United States, Banks and financial institutions offers a wide range of credit cards catering to various needs and preference of their customers. Credit card issuers such as American Express, Discover, Bank of America, Citi, and Wells Fargo provide various card options mainly categorized into various types based on their features and intended use. Below are some of these categories

You may also like to read

Click here > How Credit Card Crisis Impact on You

Click here > 8 Money Habits Keeping You Broke And Poor

You should select the correct credit card depending upon your use-case, unique financial goals and objectives.

Building Credit Score / Credit History

The fundamental benefit of using a credit card is that, it helps you to build a credit history which further helps to improve your credit score. A credit score is a score which is assigned to an individual based on their past debt payment history.

This score is improved once an individual pays their dues on time. This signifies that the individual uses their debt responsibly and chances of default in future is less.

There are various factors that affect credit scores such as Payment History, Credit Utilization, age of Credit History, Types of loans in Use. When an individual approaches to financial institutions for issuance of a credit card or a loan, these institutions use Credit Score to evaluate the credit worthiness of an individual, and if they are satisfied then your request us approved.

For individuals with low credit score and poor credit history, credit cards are not easily issued. Financial institutions have an opinion that they might default on the dues due to their past poor credit history. For such individuals with low credit score, secured credit card is an excellent starting point. It is a credit card issued against a security deposit which acts as a collateral for their credit line. These credit cards may have lower credit limits, but these card serves as a great starting point for one with low credit score.

The challenge of Credit card debt

Using credit cards does have some advantages and disadvantages as well, one such disadvantage is credit card debt.

When an individual holds a credit card, there is high probability that he might get indulged in impulse purchase and pile up heavy credit card debt.

Due to such impulsive purchases made by the holder, he gets trapped i debt trap. Once he defaults any payments, he will end up paying heavy penalty by the financial institutions and a very heavy interest rate on defaulted loan.

Conclusion

To conclude this article, we can say that owning a credit card is a doble edged sword. It can help you to enjoy interest free credit, cashbacks, rewards for your spends and freebies etc but if credit card is not used with financial discipline and planning then it might backfire and trap you in never ending credit card debt. It is advised to use credit care wisely and in a discipline manner.